Operating under the brand names "Always Money™" and "The Quik Pawn Shop", we are a privately-owned specialty financial services company that operates over 100 locations in the states of Alabama, South Carolina, and Mississippi. Our services include pawn loans, title loans, short-term cash advances, installment loans, check cashing and other related financial services.

With over 35 years in business (our first store opened in1978), we know that everyone has different needs and different resources and that's why we offer a variety of loan products to ensure there's one for everyone. Here at Always Money™, we want our customers, neighbors and friends to know they can get cash when they need it to help resolve their short-term financial needs.

Our process is simple, quick and confidential. Our service is high-quality and always professional.

We are actively involved in each of our communities. Sponsoring both national and local charities such as the Muscular Dystrophy Association, we strive to help make our communities better places to live for everyone.

Since Always Money™ holds its customers in the highest regard; we fully comply with the CFSA Best Practices. These best practices include providing full disclosure to customers, complying with all state and federal laws, advertising truthfully, encouraging, and promoting consumer responsibility.

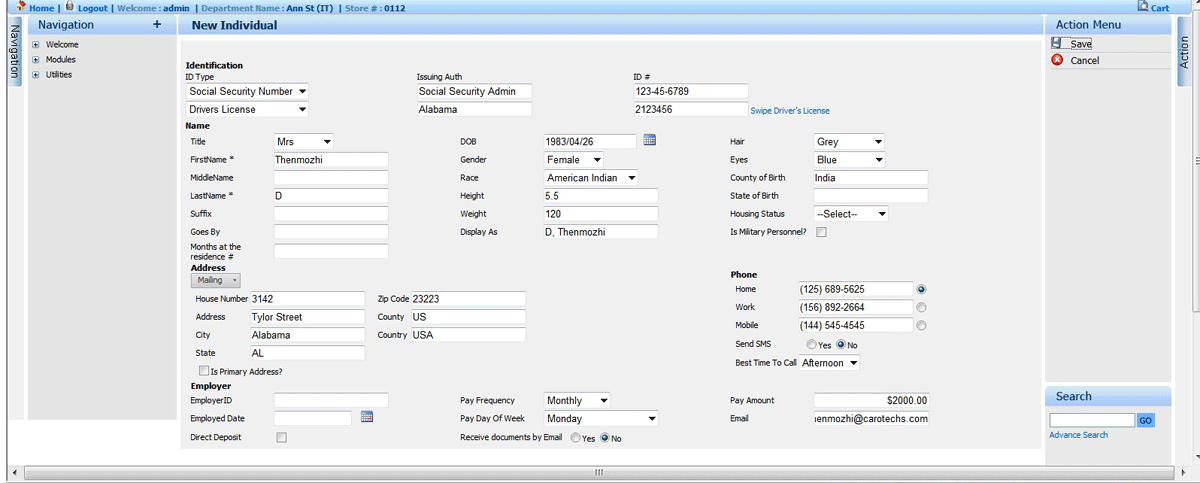

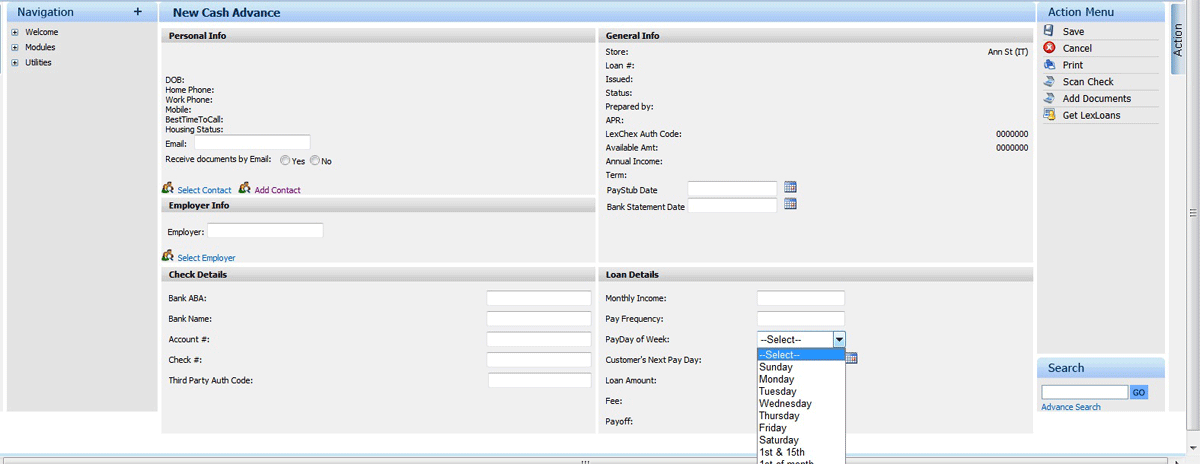

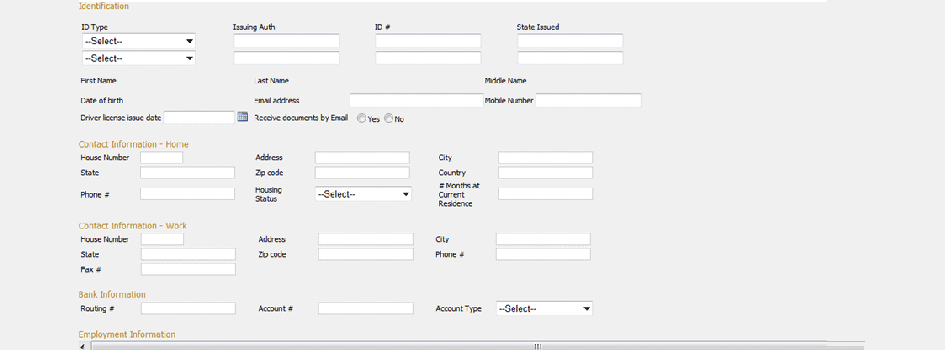

CONTACT CREATION:

For any type of loans system will first ask you create customer information, if already entered contact then we can search by filters and we can give the loan. Otherwise we need to create the contact in our system.

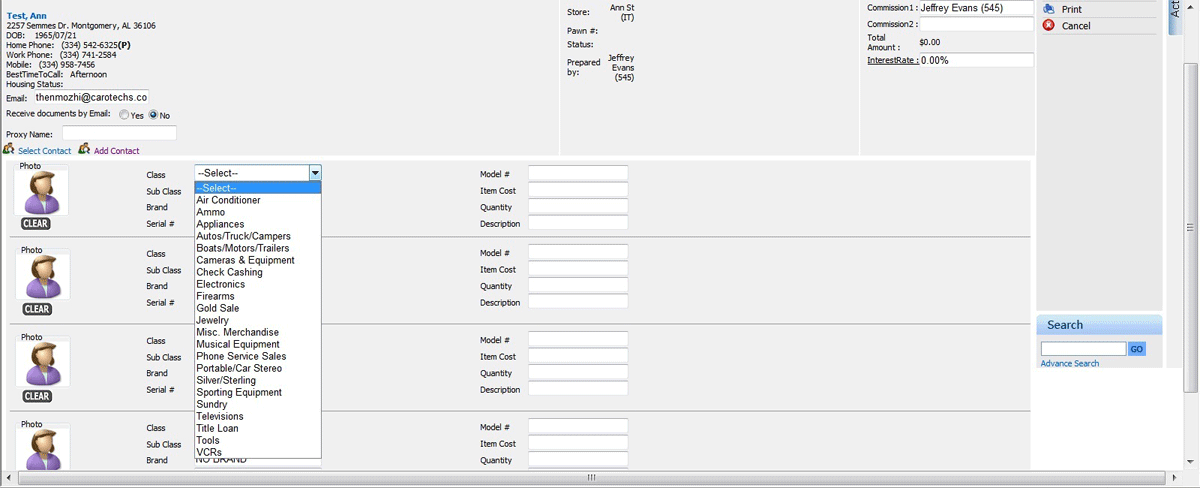

PAWN LOAN

A Pawn is a collateral loan

That means that TMG will loan you money on valuable items you own that will act as collateral. To transact a pawn loan you will need a valid state-issued photo I.D. or driver's license. Our pawn process is very simple and these four steps generally take less than 10 minutes to initiate.

- Bring in your collateral to any pawn shop.

- Pawn stores can buy the item outright or you can secure a loan against your valuables – it's your choice

- Pawn stores will set a due date (usually 30-days) for you to pay off your loan and pick up your collateral

At the end of your contract term, you may choose: - to extend the loan to a new date or

- to not pay back the loan – in which case Pawn stores will keep your item

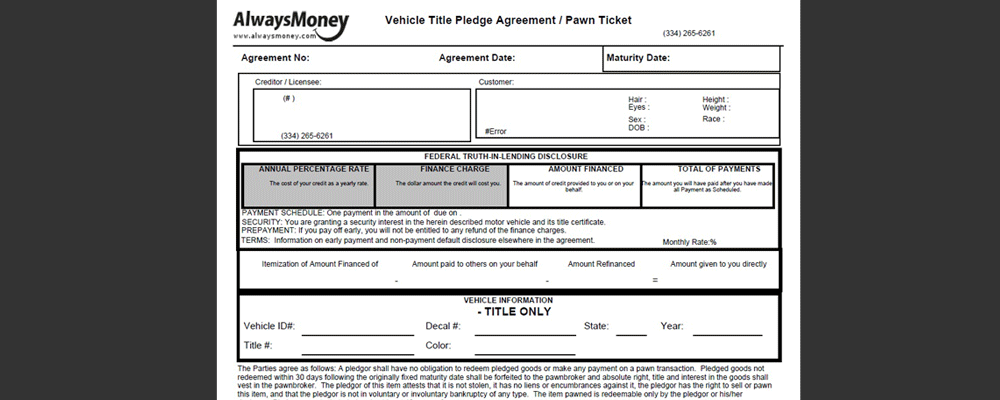

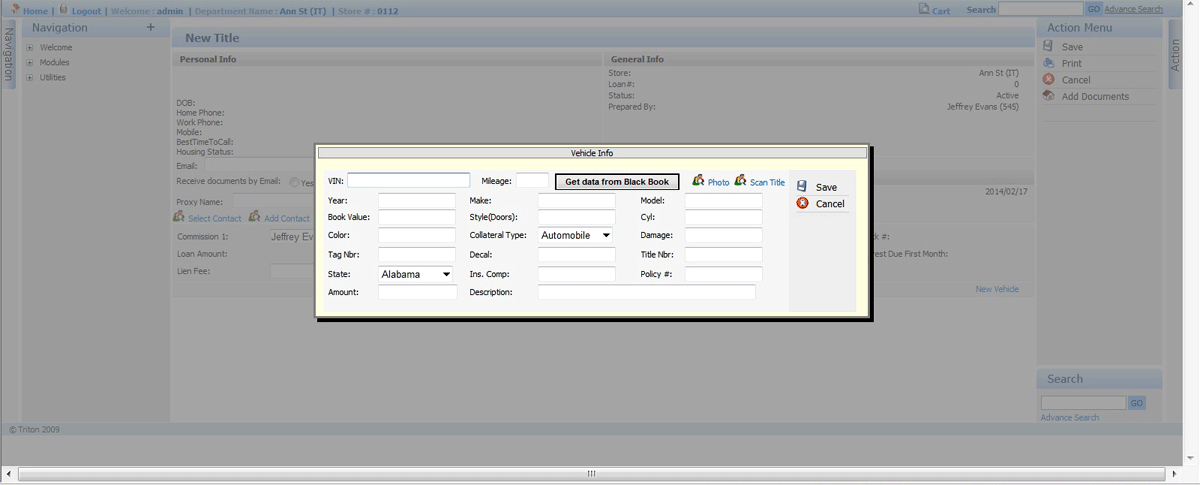

TITLE LOAN

In the United States, a car title loan, also called an auto title loan, pink slip loan or simply title loan, is a type of secured loan where the borrower can use their vehicle title as collateral. Borrowers who get title loans must allow a lender to place a lien on their car title, and temporarily surrender the hard copy of their vehicle title, in exchange for a loan amount. When the loan is repaid, the lien is removed and the car title is returned to its owner. If the borrower defaults on their payments then the lender is liable to repossess the vehicle and sell it to repay the borrowers' outstanding debt.

These loans are typically short-term, and tend to carry higher interest rates than other sources of credit. Lenders typically do not check the credit history of borrowers for these loans and only consider the value and condition of the vehicle that is being used to secure it.

Title contract

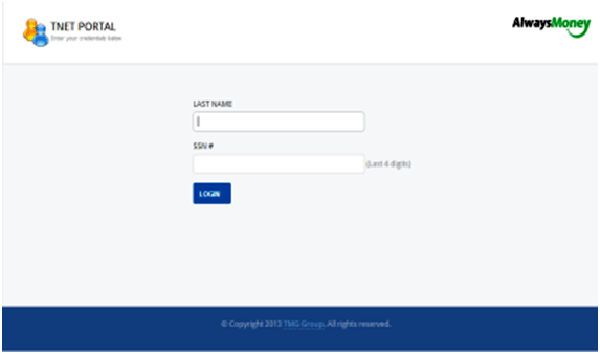

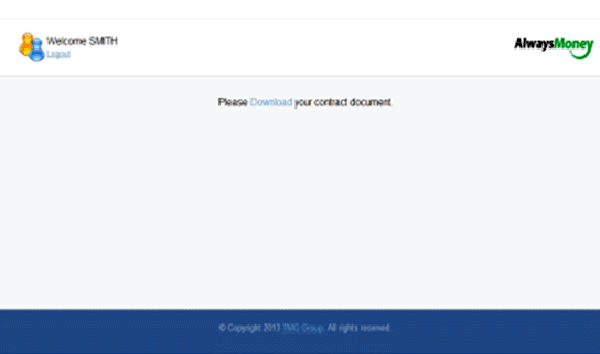

Portal for Customer Contract

- This is about electronically delivering copies of loan to customers via email-links and downloads. That is, an email is triggered from TNetApp by the user/store-agent when the customer chose to receive electronic copies of loan documents.

- There exists functionality in TNetApp for user to send documents to customers. This should be secured and prevent any accident errors that would lead wrong delivery i.e sending it to unintended persons. As the loan document is a secret and legal material, it must be protected and delivered to the customer with authenticity.

CASH ADVANCE /PAY DAY LOANS

A service provided by many credit card issuers allowing cardholders to withdraw a certain amount of cash, either through an ATM or directly from a bank or other financial agency. Cash advances typically carry a high interest rate - even higher than credit card itself - and the interest begins to accrue immediately. On the plus side, cash advances are quick and easy to obtain in a pinch.

CIL LOANS

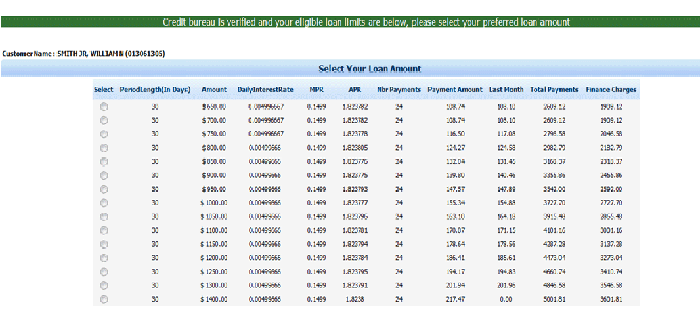

An installment loan is a loan that is repaid over time with a set number of scheduled payments; normally at least two payments are made towards the loan. The term of loan may be as little as a few months and as long as 30 years. A mortgage, for example, is a type of installment loan.

The term is most strongly associated with traditional consumer loans, originated and serviced locally, and repaid over time by regular payments of principal and interest. These "installment loans" are generally considered to be safe and affordable alternatives to payday and title loans, and to open ended credit such as credit cards.

Loan schedule

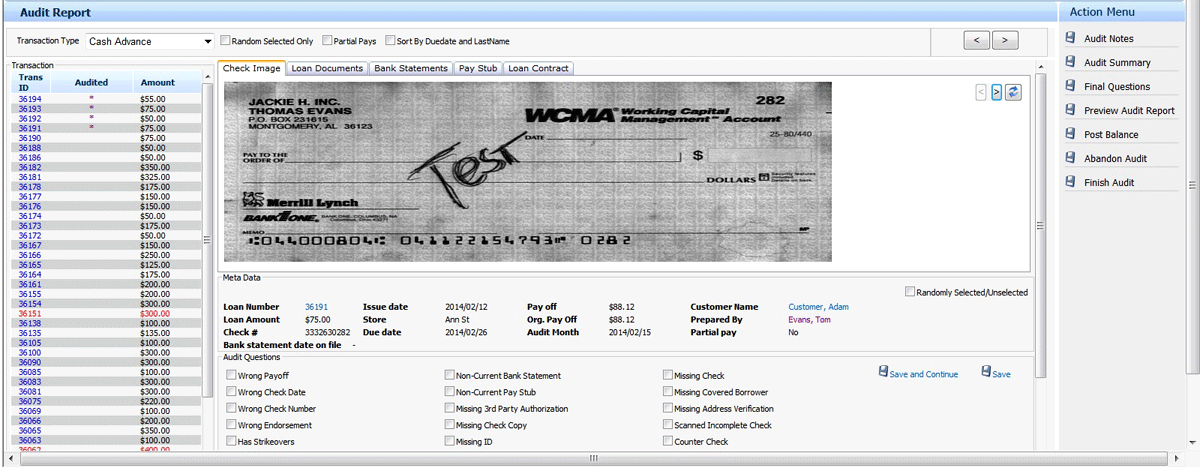

AUDIT (ONLINE)

Financial audits exist to add credibility to the implied assertion by an organization's management that its financial statements fairly represent the organization's position and performance to the firm's stakeholders. The principal stakeholders of a company are typically its shareholders, but other parties such as tax authorities, banks, regulators, suppliers, customers and employees may also have an interest in knowing that the financial statements are presented fairly, in all material aspects. An audit is not designed to provide absolute assurance, being based on sampling and not the testing of all transactions and balances; rather it is designed to reduce the risk of a material financial statement misstatement whether cased by fraud or error.

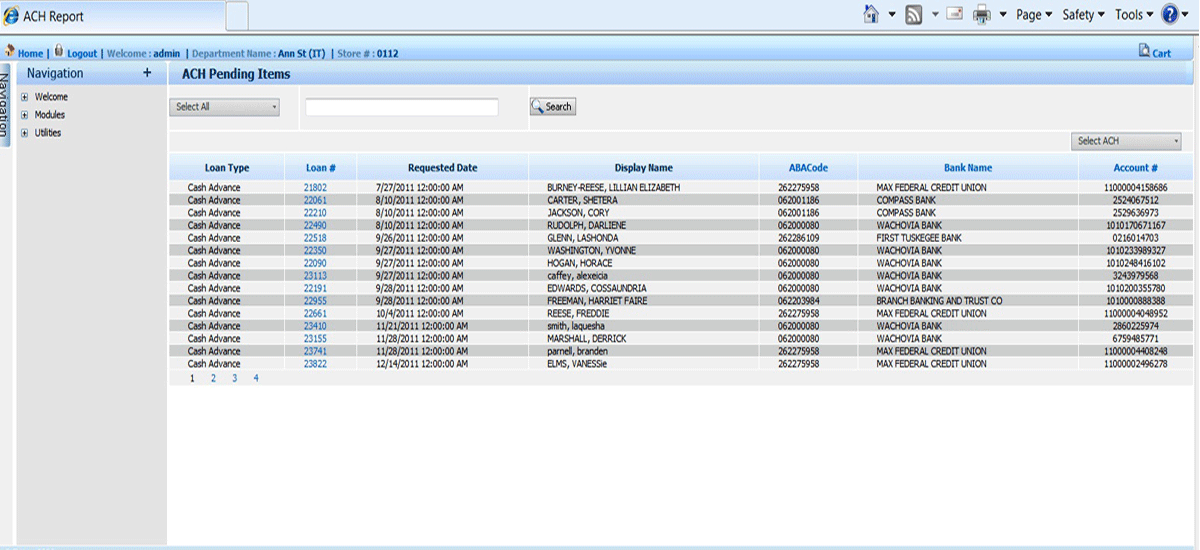

ACH

Automated Clearing House (ACH) is an electronic network for financial transactions in the United States. ACH processes large volumes of credit and debit transactions in batches. ACH credit transfers include direct deposit payroll and vendor payments. ACH direct debit transfers include consumer payments on insurance premiums, mortgage loans, and other kinds of bills

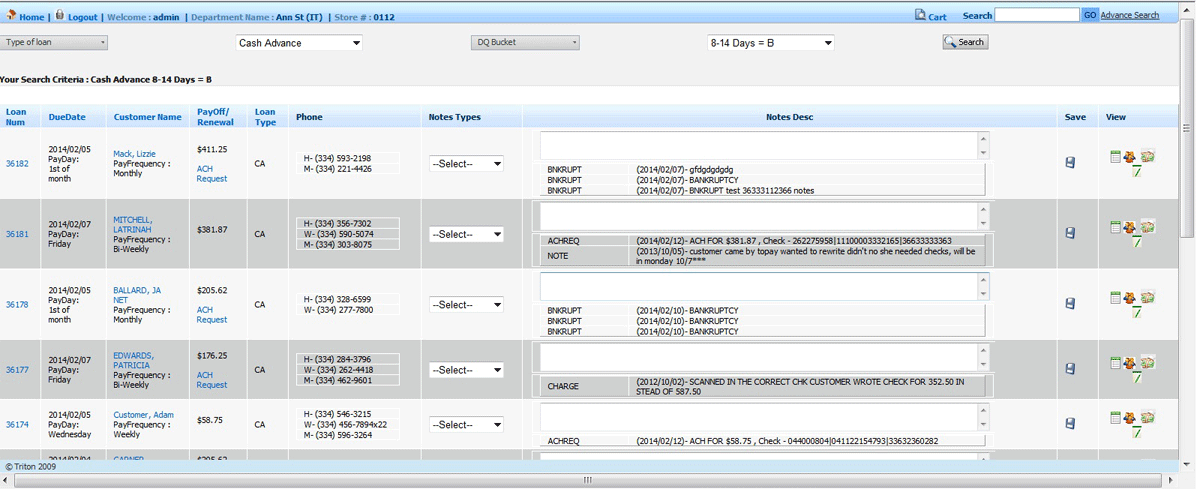

DQ

Delinquency / Delinquencies Failure to repay an obligation when due or as agreed. In CIL (consumer installment loans), missing two successive payments will normally make the account delinquent.

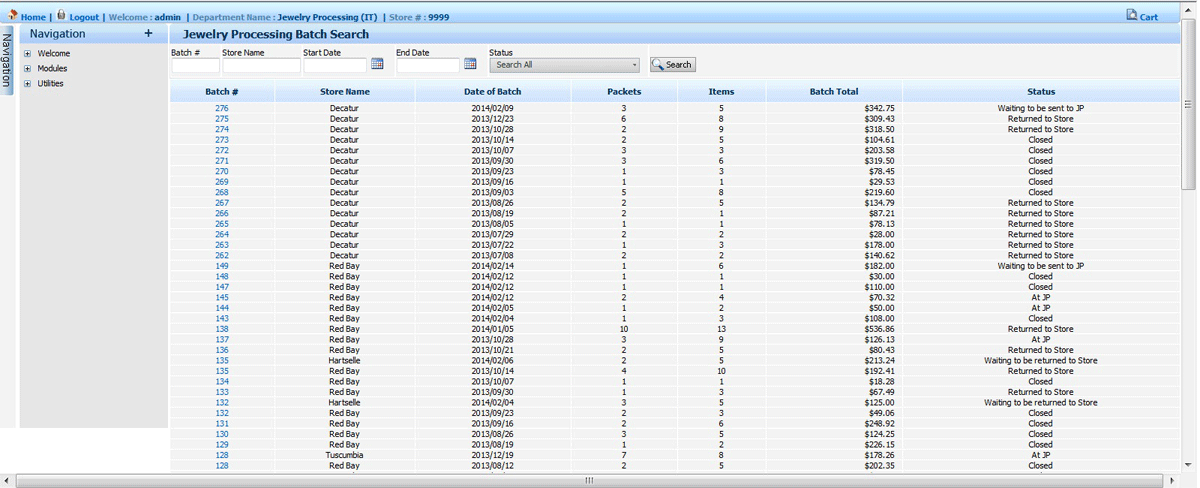

JEWELRY PROCESSING

Jewelry processing is the functional part of Inventory Management system.

All the jewels which are either purchased or forfeited in different stores will be sending to processing store. After processing the jewels it can be transferred to Inventory.

REPORTING

Dashboards are intended to make it easy to monitor your business performance so you can make better, more informed decisions that move the entire business forward. An effective dashboard inspires action, keeps you up to date on the status of key metrics, and answers important questions about your business

Get personalized visibility into bookings, billings, receivables, period-on-period performance, actual vs. budget and actual vs. forecast, and much more.